Thailand’s government approved new amendments to the country’s Civil and Commercial Code (CCC) aimed at improving the business climate.

In June 2020, Thailand’s government approved new amendments to the Civil and Commercial Code (CCC) to simplify the process of setting up and conducting business in the country. It is anticipated that the proposed amendments will become law towards the end of 2020 or the beginning of 2021.

The changes to the CCC relate to simplifying the company formation process, new merger provisions, and a set timeline for the payment of dividends, among other amendments.

The changes in the CCC is part of the government’s efforts of ongoing regulatory reforms that provide additional clarity to doing business in the country. The government has also issued various stimulus packages to mitigate some of the immediate impact caused by the COVID-19 pandemic.

Thailand’s economic outlook expected to perform the worst in Southeast Asia with the central bank forecasting a GDP contraction of 8.1 percent in 2020; surpassing the plunge during the Asian Financial Crisis more than two decades ago.

Streamlining the company formation process

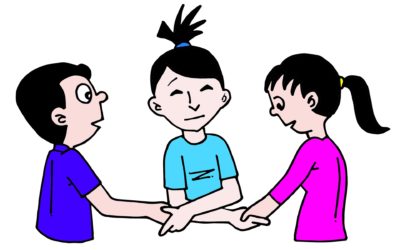

Previously, a minimum of three Thai citizens (known as promoters) is required to form a company and become the initial shareholders of the business.

With the amendment to the CCC, this has been reduced to just two, which is a positive move for foreign investors, many of whom find it difficult to find suitable promoters. This is not the first time the CCC was amended to reduce the number of promoters needed to establish a company. In 1925 – when the CCC first came into force – the number of required promoters was seven before it was reduced in an amendment in 2008 to three.

Court order dissolutions

The CCC provides that a company can be dissolved by court order if the number of shareholders is less than three. This has been changed to reflect the aforementioned amendments on the number of promoters needed to establish a company in Thailand.

Merger provisions

Before the amendments, the CCC only recognized the concept of amalgamation of companies as opposed to mergers.

Under this concept, two or more companies are combined, along with their assets and liabilities, to form a newly formed business entity. Through a merger process, however, two companies are merged into a single entity (A+B), with the remaining company (A or B) being liquidated.

The amended CCC will now recognize the concept of a merger, giving companies the choice of either an amalgamation or a merger.

Business registration

Company registration for private businesses can now be done at any approved Department of Business Development office, regardless of the location. The Ministry of Commerce is set to also waive registration fees for incorporation.

Dividend payments

The proposed amendments will formally enshrine the National Council for Peace and Order (NCPO) No. 21/2017 that mandates the payment of dividends within one month from approval of the company’s shareholders.

The amended CCC also recognizes the NCPO’s permission for companies to add procedures in their articles of associations in relation to dealing with disputes between the management team (shareholders and directors).

E-meeting provisions

The CCC will now allow e-meetings of shareholders and directors. E-meetings were first formalized by Royal Decree in April 2020, at the height of the COVID-19 spread in Thailand.

A minimum of two shareholders must attend a shareholders’ meeting in order to constitute a quorum.

This article was first published by AseanBriefing, which is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in China, Hong Kong, Vietnam, Singapore, India, and Russia. Readers may write to info@dezshira.com for more support.

SOURCE: https://www.thailand-business-news.com/law/80117-thailands-amendments-to-ease-doing-business.html

0 Comments